We use Key Performance Indicators (KPIs) to assess performance in meeting our strategic and operating objectives.

Performance is measured against the following financial, operating and sustainability KPIs:

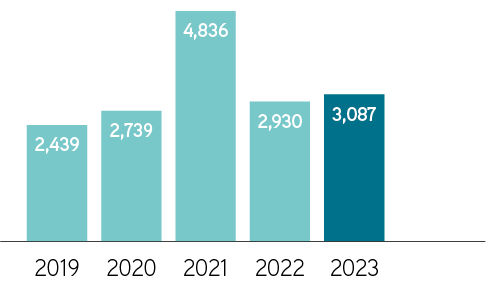

$3,087m

Why it is important

This is a measure of our underlying profitability.

Performance in 2023

EBITDA increased by 5%, driven by increases in both sales and pricing, with EBITDA margins maintained at 49%.

*1. Non-IFRS measures, refer to the alternative performance measures.

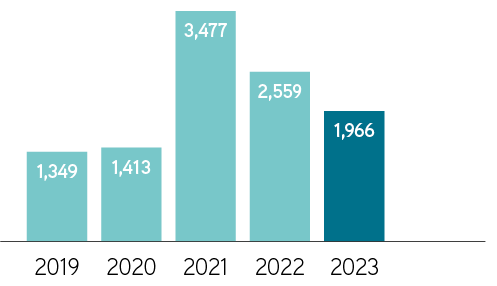

$1,966m

Why it is important

This is a measure of our profitability before the deduction of taxes.

Performance in 2023

Profit before tax (including exceptional items) fell by 23%, as a result of the recognition in 2022 of an exceptional gain relating to the disposal of the Reko Diq project, which was offset by increases in both sales and pricing, partially offset by a rise in cash costs.

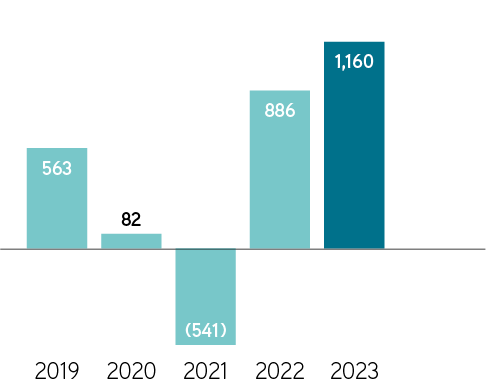

$1,160m

Why it is important

This measure reflects our financial liquidity.

Performance in 2023

Strong balance sheet with net debt of $1,160 million at the end of 2023 and a Net debt/ EBITDA ratio of 0.38x (2022: 0.30x).

*1. Non-IFRS measures, refer to the alternative performance measures.

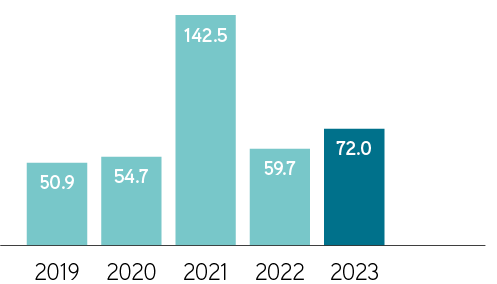

$72.0¢

Why it is important

These are measures of the profit attributable to shareholders before exceptional items.

Performance in 2023

Underlying earnings per share excluding exceptional items increased by 21% to 72 cents.

*2. From continuing operations excluding exceptional items.

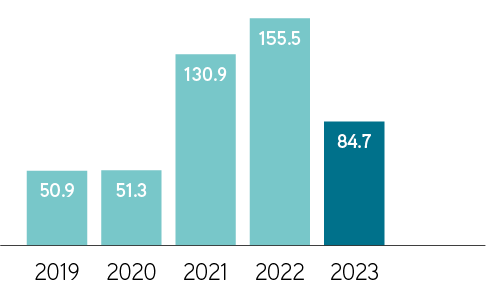

$84.7¢

Why it is important

These are measures of the profit attributable to shareholders after exceptional items.

Performance in 2023

Earnings per share including exceptional items for the year were 46% lower at 84.7 cents, relating to the recognition in 2022 of an exceptional gain relating to the disposal of the Reko Diq project.

*3. From continuing and discontinued operations including exceptional items.

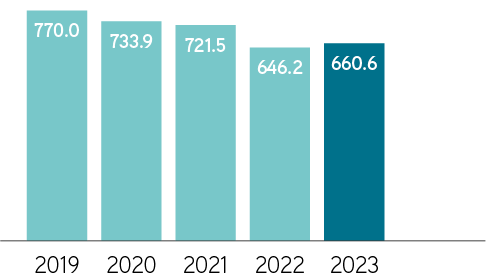

660.6k tonnes

Why it is important

Copper is our main product and largest source of revenue.

Performance in 2023

Copper production increased by 2% to 660,600 tonnes, with an increasing contribution from Los Pelambres, as the Phase 1 Expansion Project ramps up.

*5. 100% of Los Pelambres, Centinela and Antucoya, and 50% of Zaldívar’s production.

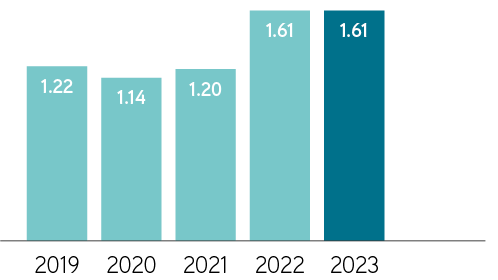

$1.61/lb

Why it is important

This is a key indicator of operating efficiency and profitability.

Performance in 2023

Net cash costs for 2023 were $1.61/lb, in line with 2022 and ahead of guidance for the year, reflecting a balance of higher underlying cash costs before by-products, alongside higher production and pricing for by-products.

*1. Non-IFRS measures, refer to the alternative performance measures.

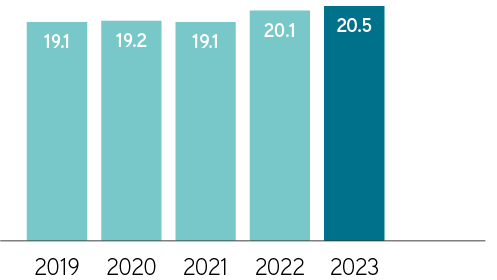

20.5bn tonnes

Why it is important

Our mineral resource base supports our strong organic growth pipeline.

Performance in 2023

Total mineral resources increased by 345 million tonnes during the year, following work at Los Pelambres.

*6. Mineral resources (including ore reserves) relating to the Group’s subsidiaries on a 100% basis and Zaldívar on a 50% basis.

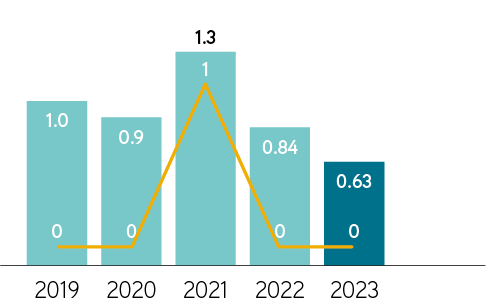

0 Fatalities

0.63 LTIFR*

Why it is important

Safety is our top priority, with fatalities and the LTIFR** being two of our principal measures of performance.

Performance in 2023

Record safety performance with no fatalities and the LTIFR improving by 25% as the Company continues to embed a safety-first culture, with improvements in leading and lagging indicators of safety.

*6. Mineral resources (including ore reserves) relating to the Group’s subsidiaries on a 100% basis and Zaldívar on a 50% basis.

**7. The Lost Time Injury Frequency Rate is the number of accidents with lost time during the year per million hours worked.

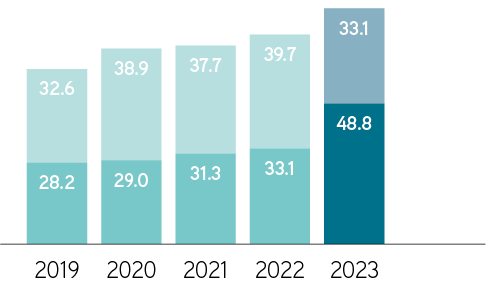

82 GL

Why it is important

Water is a precious resource and we are focused on using the most sustainable sources and maximising its efficient use.

Performance in 2023

The use of sea water as a proportion of total water withdrawals increased to 60% (2022: 45%), with the recently opened desalination plant helping to increase sea water withdrawals by 48% during the year.

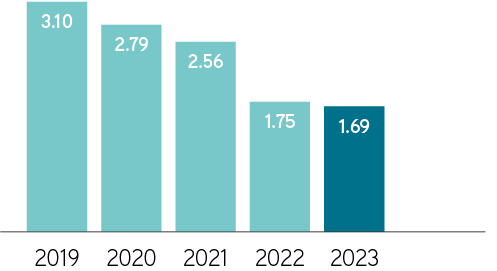

1.69 tC02e/tCu

Why it is important

We recognise the risks and opportunities arising from climate change and the need to measure and mitigate greenhouse gas (GHG) emissions.

Performance in 2023

CO2e emissions intensity decreased by 3% in 2023.

*8. Scope 1 and 2, Mining division only.

*9. Tonnes of CO2 equivalent per tonne of copper produced.